Debt once you’re in it, can feel impossible to get out of. The problem is that for many once you are in debt you end up going into the spiral of debt and it is difficult to get out of. In this blog we are going to look into what is the debt spiral, how it happens and how you can get out of it.

The debt spiral:

The debt spiral can happen to anyone, in fact some websites look at is happening to a country or a business. While this isn’t relevant to our blog and to you as a reader, it does highlight to us that debt can happen to anyone and we need to not be hard on ourselves if we find ourselves in this situation.

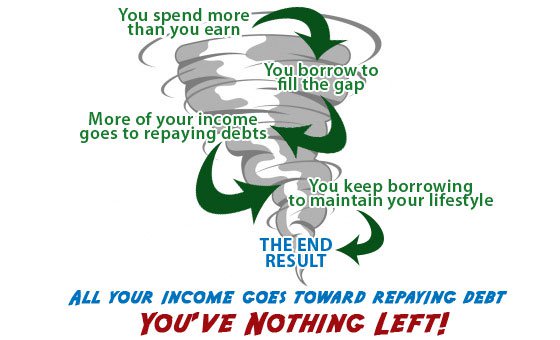

So, what is a debt spiral? In it’s simplest form a debt spiral is when your debt starts to become unmanageable and then accelerates from there. You are in a position where you can’t pay off your debt because as the balance gets larger you find that the payments you make are only paying off the interest on your debt. This can lead to more loans being taken out to pay existing ones and getting deeper into debt from there the spiral continues downwards. It’s like robbing Peter to pay Paul.

How does a debt spiral begin?

There are many reasons for a debt spiral starting, some are listed below.

- When you take out more debt than you can afford, e.g.

- Credit Card Debt

- Overspending on occasions like Black Friday or Christmas

- Gambling debts

- Because of a drop in income e.g.

- Redundancy

- Divorce

- A cut in benefits

- Sickness

- Rising living costs

- Increased energy bills

- Food prices rising

- Increase in petrol prices.

When we review the reasons above it becomes apparent that many of the reasons are external factors and not necessarily the fault of the person in debt. In the current economic climate, more and more of us are just using our entire pay packet to cover the monthly living expenses. This creates a situation where we are just not saving money for those everyday emergencies that can suddenly spring up. This means that if your boiler breaks, or your car needs a repair you don’t have the money to cover the cost. This creates a situation where people may put the cost on a credit card, which they can’t afford to pay back, or they look to take out a loan.

No matter what kicked off your debt spiral, it can be difficult to escape when you have high-rate debts. For example, if you have a £4,000 credit card balance with a 22% annual percentage rate (APR) and only make minimum payments, it could take over 21 years to pay off the card. And that assumes you’re not using the card for any new purchases. Payday loans can have much higher APRs, as can certain installment loans and lines of credit for people who have poor credit scores.

How to get out of a debt spiral?

The first thing to do is to not panic. Once you realise that you are in a debt spiral there are ways out, and the sooner into the spiral you choose to do something the easier it is going to be.

The best place to start is to list your debts, it is important to understand which debts are costing you the most and which ones you can pay off quicker. It is also important to figure out how much you owe and what the consequences of not paying each debt is.

If your debts are less than £6,000 then you might want to consider getting a loan to consolidate your debts so that you can pay off your high interest loans and then just have one payment with one interest rate to pay. However, if this strategy is used it needs to be accompanied by a good budgeting strategy. If you go back to building up debt on a credit card you may find yourself in a worse position than you were before. It may be once you have examined your expenses that you will see there are expenses in your life that you can cut back on and with some smart budgeting you can start to reduce those debts.

If your debts are over £6,000 then you might find that you need alternative solutions to help you out of your debt predicament. These could include:

- An IVA, or Protected Trust Deed if you are in Scotland

- Debt Management plan

- Debt relief order

- Bankruptcy

If you are needing to speak to a debt specialist, then give our team a call on 0800 254 5112.

To conclude:

In our current economic climate, there are more and more situations and expenses that could push us into a debt spiral. The important thing is to be aware of it and to look for ways to stop the spiral as quickly as possible. The sooner you catch yourself in a spiral the easier it is to get out of it.